Opportunity Zones

One of the most interesting things in the 2017 Tax Cuts & Jobs Act was the creation of “Opportunity Zones”, which give huge tax benefits to accredited investors who choose to reinvest their capital gains into designated low-income census tracts. If you are an investor, this could be a powerful tool to lower your taxes. Do you own a business? Check and see if your business is in an Opportunity Zone. It could possibly help you with financing.

Investors into Opportunity Zones get to defer capital gains taxes, plus a step-up in basis if the investment is held for at least five years, plus a permanent exclusion from the taxable income of capital gains made after ten years. Combined, these can boost after-tax returns up to 40%.

The economic potential is breathtaking. When the Tax Cuts & Jobs Act passed in 2017, there were $6.1 TRILLION available in eligible untaxed capital gains. These investments are often into real estate, but they can go into operating businesses as well.

210 qualified OZ funds have opened so far, and this number is growing quickly. They range in size from under $1 million to $3 billion. The National Council of State Housing Agencies has a directory of these funds on their website at https://www.ncsha.org/resource/opportunity-zone-fund-directory/.

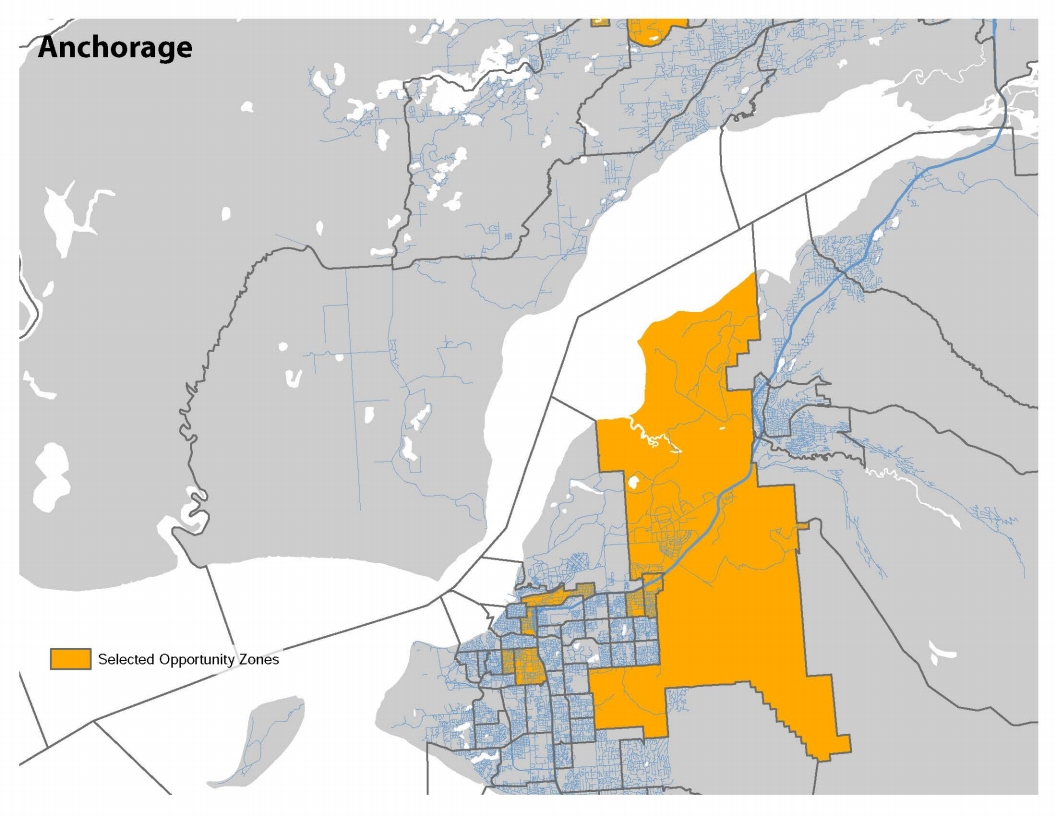

Opportunity Zones in Alaska

Alaska has 25 Opportunity Zones scattered throughout the state. Some are urban, some rural. Some of them, such most of Midtown Anchorage, are a little surprising. The full set of maps for Alaska can be seen here:AK OZ Maps. Better resolution maps of each OZ in Anchorage are available here: Anchorage OZ Maps. The Alaska Department of Commerce gives more information, along with some good tools at Alaska Opportunity Zones. No OZ funds target Alaska yet, although that seems like just a matter of time.

OZ funds represent over $47 billion in potential investment. Locating a new business inside an OZ may allow you to access some of that money. According to a good overview by Patrick Sharma at CooleyGo, a business qualifies if either:

- the management, operations and tangible property needed to generate 50% or more of the gross income of the business are located in the Opportunity Zone; or

- 50% or more of the services performed for the business by employees and independent contractors are performed in the Opportunity Zone.

So startup in an Opportunity Zone could satisfy the 50% gross income test even if its income comes from outside of the Opportunity Zone. Or a startup outside an Opportunity Zone could still pass the test if its employees and contractors spend most of their time inside the Opportunity Zone. Interesting, I say.

The IRS has a detailed FAQ available if you really want to dive in.

The Fine Print

However, all this comes with a few caveats. Not everyone can buy in. With most OZ funds, you must be an accredited investor—that is, you must have a net worth of $1 million, or have two consecutive years of at least $200,000 in annual income if you’re a single tax filer ($300,000 for married filers). Most funds come with a six-figure investment minimum, and the fees are a lot higher than many other investments.

The typical promised rate of return is 6% – 10% for funds with diversified portfolios, but it’s still too early to say what kind of gains, if any, these OZ funds will ultimately deliver. Last but not lease, the tax rules are still evolving. If an OZ fund doesn’t comply with complex and shifting IRS guidance it may have to pay a penalty the tax breaks.

Definitely a space to watch!

Are you looking for opportunities to deploy capital? Are you a business owner or entrepreneur looking for financing? Not sure where to start with Venture Capital, Growth Equity or Private Equity? The Venture North Group can provide you with a clearer understanding of what next steps to take, in Alaska or across the globe.